Estate giving

A quick guide to estate planning

Download our quick guide to estate planning including the advantages and disadvantages of each option. If you want help deciding how to leave your legacy through AVMF, contact us Monday through Friday, from 8 AM to 4 PM at 847-285-6690 or email drjohnson@avma.org.

A planned gift to AVMF can help you achieve your philanthropic goals and financial planning needs as well as significantly advance our mission to embrace and advance the wellbeing and medical care of animals. Below are some options to consider.

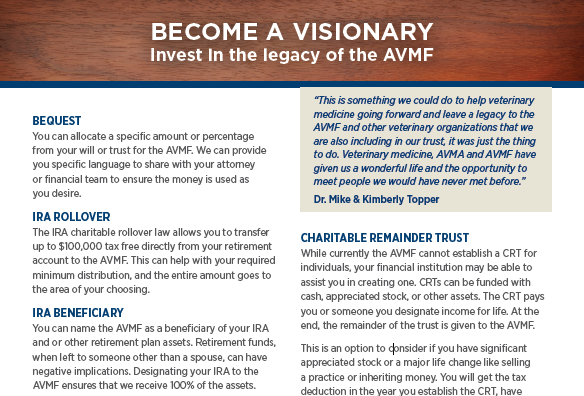

BEQUEST

You can allocate a specific amount or percentage from your will or trust for the AVMF

IRA ROLLOVER

The IRA charitable rollover law allows you to transfer up to $100,000 tax free directly from your retirement account to the AVMF.

IRA BENEFICIARY

You can name the AVMF as a beneficiary of your IRA and or other retirement plan assets.

GIFTS OF STOCK

Gifts of stock to the AVMF pay no capital gains tax on the transfer, and the entire amount will go to the area of your choosing.

CHARITABLE REMAINDER TRUST

While currently the AVMF cannot establish a CRT for individuals, your financial institution may be able to assist you in creating one. CRTs can be funded with cash, appreciated stock, or other assets. The CRT pays you or someone you designate income for life. At the end, the remainder of the trust is given to the AVMF.

See below to download our quick guide to estate planning.